----------------------------------------------------

Series : Ratio Analysis (19 th Post)

---------------------------------------------------

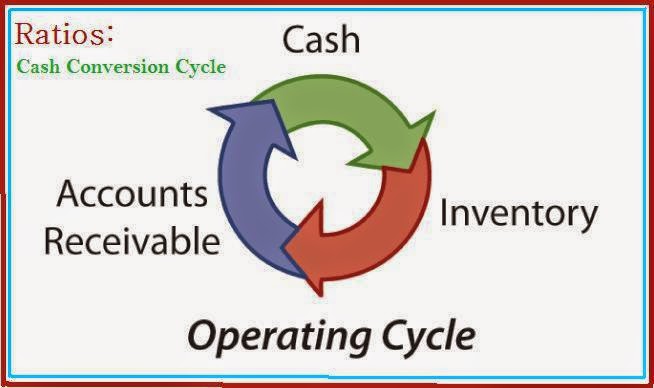

Q Is the company generating enough cash on time , from the sales of its inventory ?

This Cash Conversion Cycle or Operating Cycle

is an indicator in number of days a company takes to receive its cash from the

accounts receivable from the time purchase of its inventory.

Less Number of days means more Cash is

available quickly for additional purchases or repayment of its loans.

Formula: Operating Cycle Days or Cash

Conversion Cycle (CCC) = DIO + DSO – DPO

DIO=Days Inventory Outstanding

DSO=Days Sales Outstanding

DPO=Days Payable Outstanding

DIO is calculated as :

1. Dividing the cost of sales (income statement) by 365 to get a

cost of sales per day figure;

2. Calculating the average inventory figure by adding the year's

beginning (previous yearend amount) and ending inventory figure (both are in

the balance sheet) and dividing by 2 to obtain an average amount of inventory

for any given year; and

3.

Dividing the average

inventory figure by the cost of sales per day figure.

DSO is calculated as :

- Dividing net sales (income statement) by 365 to get net

sales per day figure;

- Calculating the average accounts receivable figure by

adding the year's beginning (previous yearend amount) and ending accounts

receivable amount (both figures are in the balance sheet) and dividing by

2 to obtain an average amount of accounts receivable for any given year;

and

- Dividing the average accounts receivable figure by the

net sales per day figure.

DPO is calculated as :

- Dividing the

cost of sales (income statement) by 365 to get a cost of sales per day

figure;

- Calculating the

average accounts payable figure by adding the year's beginning (previous

yearend amount) and ending accounts payable amount (both figures are in

the balance sheet), and dividing by 2 to get an average accounts payable

amount for any given year; and

Dividing the average accounts payable figure by the cost of sales per

day figure.

Next Post on Ratio Analysis: Cash

Flow Indicator Ratios

-------------------------------------------------------------------------

In my quest for learning value investing I came acrros this interesting

article and thought would like to share this with the community

Comments / Improvements and points worth considering are welcome

Google Feedburner is free & allows to

directly deliver any new post on this blog to your email .If you are

interested kindly enter your Email in the “Subscribe Via

Email” on the top left hand side of the navigation menu’s.

Related Articles

Understanding these facts on stock market trading as discussed here helps to understand market behavior in a better way. Also to increase the probability of earning high returns by trading in commodities always use experts suggested commodity tips while trading .

ReplyDelete